6 Benefits of Outsourcing Accounting Services

Running a business is not an easy fleet. Many small businesses fail within their first year, often because owners try to manage everything themselves. Building a thriving business requires strategic focus and efficient delegation.

One critical decision every business owner must make is knowing what they do the best and focusing on it while delegating or outsourcing other work. Accounting is one of the essential functions of every business. Yet, it’s also one of the easiest functions to outsource. In fact, according to Capterra, over 70% of businesses outsourced some or all of their accounting and finance needs.

So, why are so many businesses choosing accounting outsourcing? In this blog, we’ll dive into the top 6 benefits of outsourcing accounting services and how they can help your business thrive.

What is Accounting Outsourcing?

Outsourced accounting is hiring a third-party business to manage your business’s financial tasks at a fixed price.

We handle essential functions like bookkeeping, recording transactions, reconciliations, payroll management, tax filing, financial planning, and much more.

Outsourced accounting is integral to your operations since it handles all your finances, especially if you’re an owner of a small business and a booming business. We help establish a robust and reliable accounting system tailored to your business needs.

We offer comprehensive service packages, while also specializing in areas like taxation and audits, ensuring your financial processes are in capable hands.

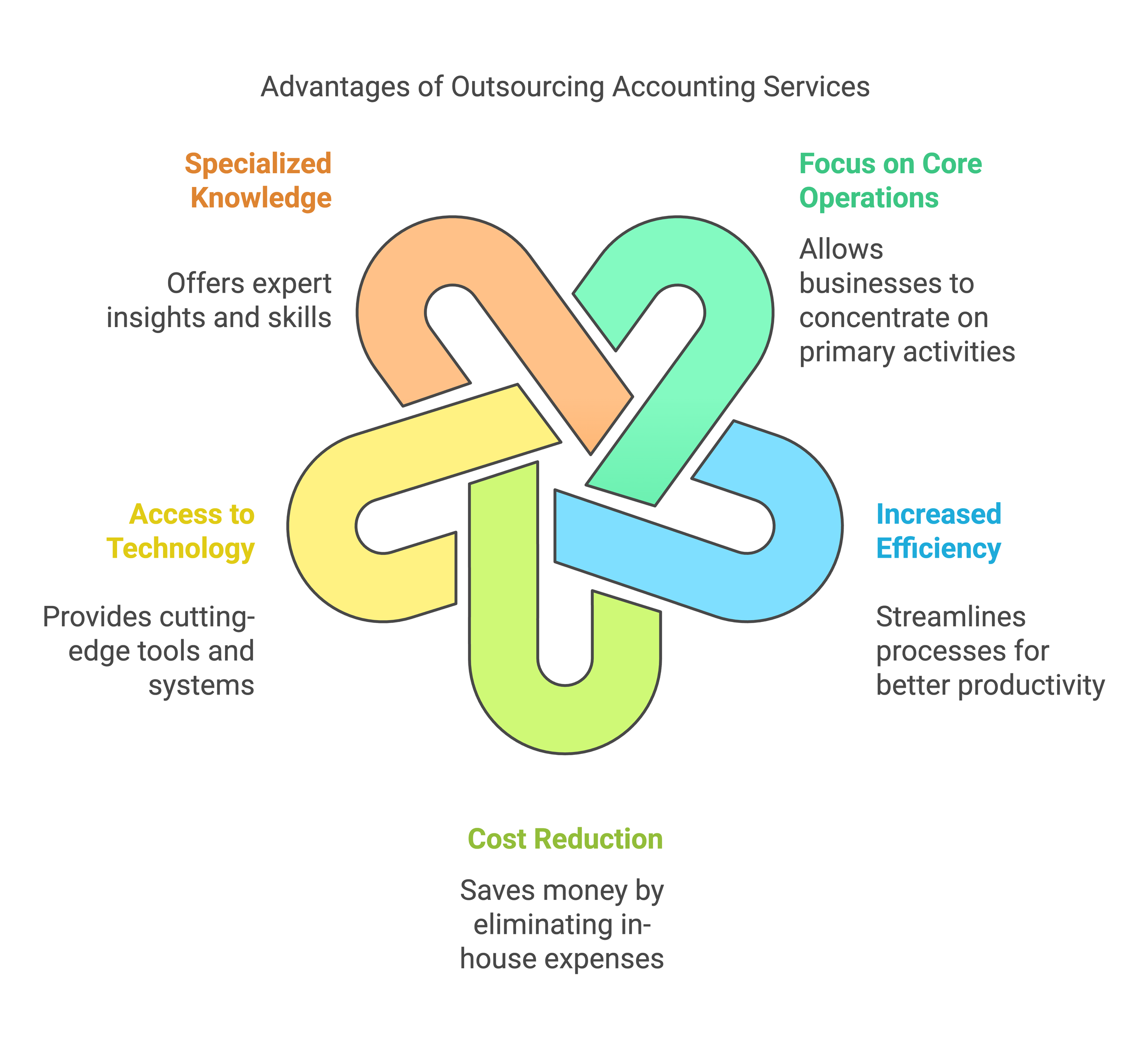

Benefits of Outsourcing Accounting Services

Cost Savings and Efficiency

As a business owner, you know what works best for your company. However, hiring in-house employees can be expensive and time-consuming. Finding the right talent is complex, and even after finding the right people, you cannot count on them to hand you profit and success in the first few weeks.

On the other hand, outsourcing offers a smarter alternative. Hiring a reputable firm like Hudson & Empire allows you to access expert accounting services at a fraction of the cost. In addition, hiring a company that performs all the accounting services or a specialized service that deals with limited functions can help overcome staff shortages.

These firms come equipped with advanced software and tools, sparing you the expense of purchasing them. Outsourcing allows you to focus on other integral business areas, like customer relationships, operational efficiency, and team building.

Access to Expertise and Specialized Skills

One of the significant advantages of outsourcing your accounting is the fresh perspective it brings. We can identify issues and opportunities that may otherwise go unnoticed. Unlike your in-house teams, who are deeply involved in day-to-day operations, We focus solely on your business’s finances. Hence, we offer unbiased and thorough assessments.

Our professional team can even provide you with insights on how you can upgrade your financial stability. In addition, we can provide you with perfect and beneficial insights about your investments.

Stress of Hiring

Hiring a professional accountant is yet another major challenge that many businesses face. According to the CPA Journal, about 75% of U.S. accountants are nearing retirement age, and the number of CPA exam candidates has dropped by 33% since 2016.

Outsourcing to experienced firms like ours offers a practical solution. We provide access to skilled CPAs and finance professionals with expertise in sectors such as GovCon, nonprofits, tech, and foreign corporations with U.S. subsidiaries.

By outsourcing, businesses can overcome staffing challenges while ensuring expert financial management.

Legislative Support

Legislation and compliances change every year. However, businesses need to stay up-to-date with the latest laws and regulations.

Therefore, you need to constantly train your employees to keep up with these changes, such as GAAP and IFRS valuation updates. This can sometimes become complex and expensive, especially when dealing with tax procedures and legal obligations.

By outsourcing your accounting services, you work with a team of experts who stay on top of the latest regulations. We will manage your accounting processes, tax procedures and legal obligations- no matter how complex. Ensuring your business complies with IRS, US GAAP, UK GAAP, IFRS, and other industry standards.

This will also help you reduce your in-house training costs and avoid unnecessary penalties due to compliance issues.

Fewer Chances of Errors

Bookkeeping errors are inevitable. Even the most experienced in-house bookkeepers may take time to adapt, and new hires are especially prone to mistakes during their initial period.

The consequences of such errors can be severe. U.S. companies amassed almost $7 billion in IRS civil penalties due to incorrect data handling and spreadsheet errors.

However, one of the most crucial benefits of outsourcing bookkeeping is the significant reduction in errors and fraud. By letting us handle your accounts, you minimize the chances of mistakes and mitigate the risk of financial consequences, such as fraud.

We use advanced automated bookkeeping software to track your finances accurately, while our expertise ensures any issues are quickly identified and resolved. This approach helps safeguard your business against costly errors and potential fraud.

Strong Financial Projections

If you are focused on growth and have new plans in the pipeline, it’s time for you to think about outsourced accounting and bookkeeping services.

We can speed up your business operations and provide valuable insights that help you foresee potential issues before they occur.

We can create accurate 13-week cash flow projections, which are vital for understanding when your business might run out of cash. By knowing this in advance, you can take proactive measures, such as discussing necessary funds with your bank, to ensure your business stays afloat and can cover expenses without disruption.

Outsourcing your accounting needs gives you the financial clarity and foresight to make informed decisions and avoid financial crises, ultimately contributing to long-term business stability.

Conclusion

Outsourcing your accounting and financial services offers a range of benefits, from cost savings and access to specialized expertise to minimizing errors and ensuring compliance.

By partnering with a trusted firm like us, you can alleviate the pressure of managing complex financial tasks and focus on growing your business. With our extensive knowledge and use of cutting-edge tools, we are dedicated to providing businesses with accurate financial insights, strong projections, and a solid foundation for long-term success.

Ready to streamline your financial operations and drive your business forward? Contact Hudson & Empire today and let our experts handle your accounting and financial needs, so you can focus on what matters most—growing your business!